Not even close. In fact, you’ve already been paying transaction or service fees in your everyday life — often without realizing it.

Think about it — whenever you order food online, buy event tickets, pay for parking, book travel, or even make certain government or utility payments with a credit card, there’s almost always a “service,” “convenience,” or “processing” fee built in.

These fees are everywhere — from delivery apps to online ticketing platforms, subscription services, and public institutions. And most people accept them without a second thought. Why? Because when they’re clear and upfront, they feel completely normal.

That’s exactly how Dual Pricing works: it’s transparent, optional, and respectful. Your customers are already used to seeing small fees for card convenience — so when you give them the choice (credit with a small fee vs. debit or cash with no fee), it won’t be a shock.

In fact, most merchants find their customers are far more understanding than expected — and the savings start showing up immediately.

Worried your customers will push back? Let us show you how transparent, respectful surcharging can protect your margins — without hurting loyalty.

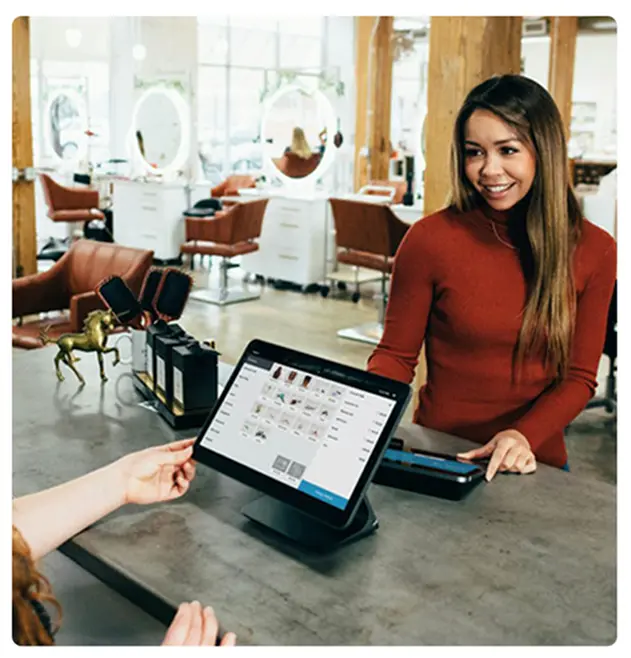

See a TransactionOur POS faq section is here to answer the most common questions merchants have about using a point-of-sale system. From installation and setup to payment processing, transaction fees, integrations, and troubleshooting, we cover everything you need to know.

Answer: Most customers understand surcharging when it’s communicated clearly and respectfully. In fact, many appreciate the option to avoid the fee by paying with debit, cash, or e-transfer.

Merchants who display professional signage and provide simple payment choices typically experience minimal resistance. Studies show that customer satisfaction remains strong when surcharges are transparent, optional, and easy to understand.

Answer: It’s a valid concern — but the data says otherwise. When implemented correctly, surcharging has little to no impact on customer loyalty.

Customers are already used to seeing service fees in many industries. What matters most is that the fee is clearly disclosed and that they have the choice to avoid it by using debit, cash, or e-transfer.

In fact, many merchants find that surcharging helps protect their margins without affecting long-term relationships — especially when paired with great service and transparent signage.

Yes — credit card surcharging is legal in Canada, except in the province of Quebec, where it is prohibited by law.